At the start of Nicolás Maduro’s presidency, Raúl Gorrín and the new leadership at Pdvsa employed the same opaque scheme that originated the loan agreement in bolívares payable in dollars signed with the Administradora Atlantic 17107 CA during Hugo Chávez’s administration, which was denounced as “illegal” on Tuesday by the Minister of Oil, Tarek El Aissami, before the Maduro regime’s Prosecutor’s Office.

According to El Aissami, Rafael Ramírez and his associates allegedly “embezzled” over four billion dollars from the oil company’s coffers through irregular currency operations that generated grotesque profits for the perpetrators. This figure is approximate, as the original contract saw several subsequent amendments.

The day after the oil minister’s denunciation, Tarek William Saab announced the arrest of Víctor Aular, former vice president of Finance at Pdvsa, as part of what he described as the beginning of an investigation involving former Pdvsa president Rafael Ramírez, financial operators Luis and Ignacio Oberto Anselmi, owner of Derwick Associates Alejandro Betancourt, Nervis Villalobos, former deputy minister of Energy, and Abraham Ortega Morales, former head of Finance and International Operations at Pdvsa, among others.

The contract with Administradora Atlantic 17107, revealed to the public by Cuentas Claras Digital in May 2016, was the first of its kind for Pdvsa but not the last.

The Atlantic building, located in the Los Palos Grandes urbanization of Caracas, is owned by Administradora Atlantic 17107 CA, a company that was owned by Bancoro before passing into the hands of Juan Andrés Wallis Brandt. Photo guiacaracas.com

The Atlantic building, located in the Los Palos Grandes urbanization of Caracas, is owned by Administradora Atlantic 17107 CA, a company that was owned by Bancoro before passing into the hands of Juan Andrés Wallis Brandt. Photo guiacaracas.com

Same Plot, Different Operators

On September 3, 2014, Maduro dismissed Ramírez, changed the management but kept Víctor Aular as the formal head of Pdvsa’s finances until December 30 of that same year when he was replaced by his political nephew Carlos Erik Malpica Flores, who, as treasurer of the nation, already held significant influence within the oil company and had a close relationship with Raúl Gorrín and Alejandro Betancourt.

On December 15, 2014, Aular received instructions from Pdvsa’s Executive Committee to sign a contract with a company linked to Raúl Gorrín. Two days later, on December 17, Aular subscribed, on behalf of PDVSA, a contract similar to Atlantic’s—a loan of bolívares payable in dollars or euros—with Rantor Capital CA for an amount of 7.2 billion bolívares.

It was during Malpica Flores’s tenure as vice president of finance that the contract between Pdvsa and Rantor was executed without any objection or observation from him, benefiting Gorrín over brothers Luis and Ignacio Oberto Anselmi, who managed the opaque business dealings of Pdvsa with currency differentials.

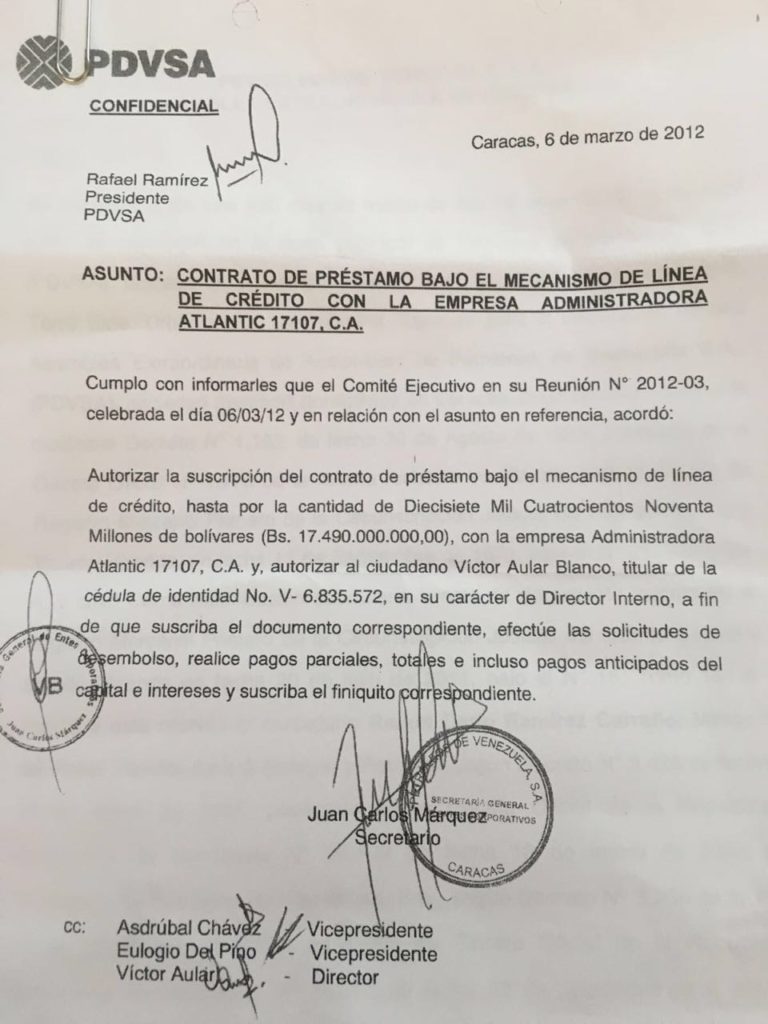

Instruction from Pdvsa’s Executive Committee to Víctor Aular for signing the contract with Administradora Atlantic 17107, CA. Photo archive CCD.

Instruction from Pdvsa’s Executive Committee to Víctor Aular for signing the contract with Administradora Atlantic 17107, CA. Photo archive CCD.

Rantor Capital CA is a shell company registered in Anzoátegui state, whose real owner is Raúl Gorrín, as determined by an investigation carried out by this medium in 2018. This inquiry established that Rantor was registered in the Second Commercial Registry of Anzoátegui when the registrar was Javier E. Franceschi Dávila, current director of Globovisión, just as he had done with a dozen paper companies registered under a family member’s name, Nelson Enrique Meneses Franceschi and Elizabeth de Goveia, personal assistant to Raúl Gorrín.

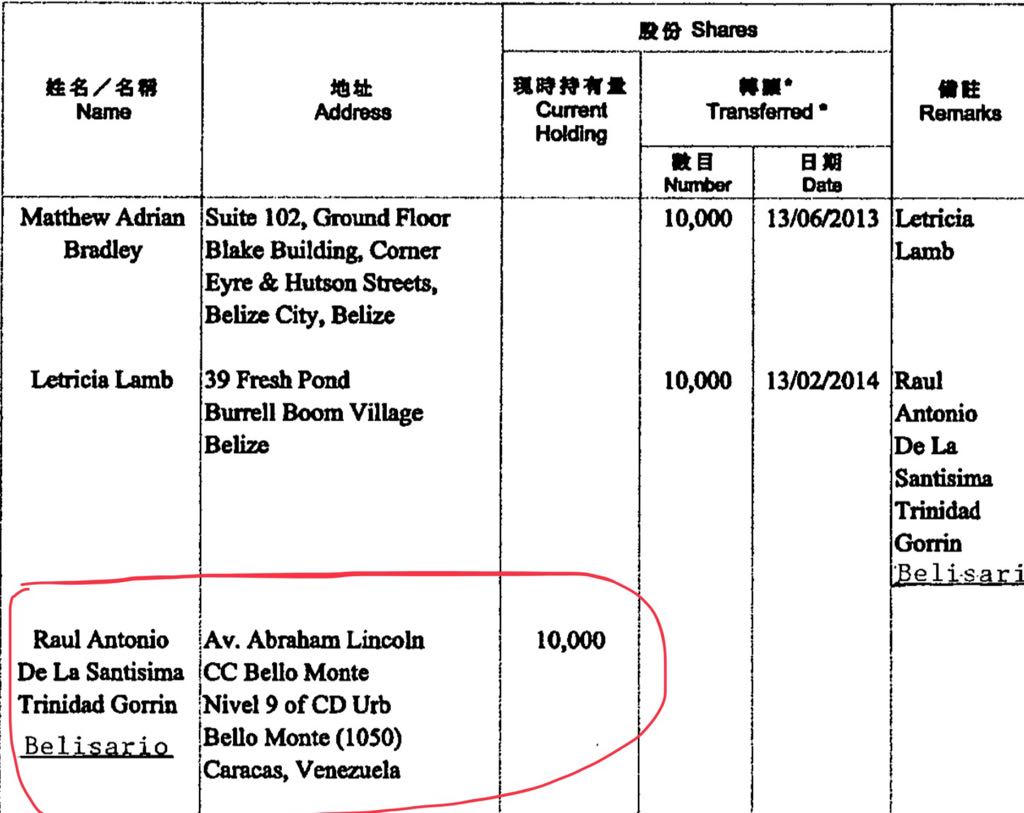

Two weeks after the signing of this contract, following the Atlantic model that transferred debts to Violet Advisors SA and Welka Holdings Limited, companies of Luis Alfonso Oberto, Rantor ceded its rights as a creditor of PDVSA to another shell company called Eaton Global Services Ltd, registered in Hong Kong, whose sole owner is Raúl Gorrín Belisario, as indicated in the registration document obtained by Cuentas Claras Digital.

Registration of Eaton Global Services Ltd in Hong Kong showing Raúl Gorrín Belisario as the owner of the company. Photo archive CCD.

Registration of Eaton Global Services Ltd in Hong Kong showing Raúl Gorrín Belisario as the owner of the company. Photo archive CCD.

In the subsequent notification to Pdvsa’s vice president of finance, it was bizarrely indicated that since Eaton was a company established in Hong Kong and does not have an account in legal tender in Venezuela, the loan payments could be received in dollars or any other convertible currency.

As a result, PDVSA made payments into the accounts specified by the aforementioned company on various dates from December 29, 2014, to February 2, 2015, totaling 511 million 913 thousand 270.74 euros, an amount equivalent to 600 million US dollars, corresponding to the 7.2 billion bolívares of the loan granted to PDVSA, calculated at the official exchange rate of 6.30 bolívares per dollar at that time.

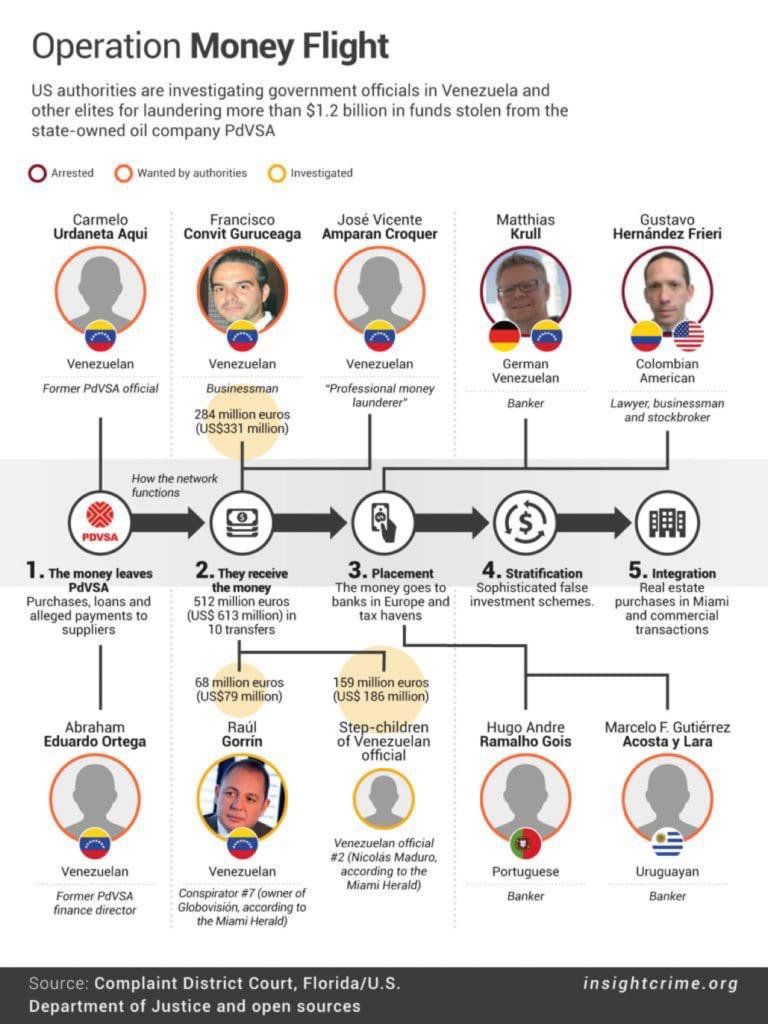

The Relationship Between Pdvsa-Rantor Contract and the Money Flight Operation

The loan agreement in bolívares payable in dollars between Pdvsa and Rantor later gave rise to the Money Flight operation or “Fuga de dinero,” also known as the case of 1.2 billion dollars, a corruption scheme in Pdvsa uncovered by US authorities implicating Francisco Convit Guruceaga (partner of Alejandro Betancourt in Derwick Associates), José Vicente Amparan Croquer, Carmelo Urdaneta Aquí, Abraham Edgardo Ortega, Gustavo Adolfo Hernández Frieri, and Matthias Krull, among others. Some of them are already detained, including financial operators Krull and Hernández Frieri, and former officials Ortega and Urdaneta, the latter accused of having received dollar transfers as bribes via financial operator Pedro Binaggia, who recorded several meetings evidencing the conspiracy to violate US anti-corruption laws.

Investigated in the Money Flight Operation. Source: Insightcrime.org

Investigated in the Money Flight Operation. Source: Insightcrime.org

The actions of American justice can be explained because part of the dollars obtained through the contract between Pdvsa and Rantor were used to pay bribes to oil company officials and Nicolás Maduro’s family members (his stepchildren) through accounts in the US or via US dollars, as financial operator Pedro Binaggia reported to the authorities, stating he had received instructions from Raúl Gorrín himself to finalize the payment of the bribes. Consequently, Binaggia was incorporated into the investigation as a “confidential source.”

Other names are believed to appear in the indictment that have not yet been formally revealed in the case file, including Raúl Gorrín. It is suspected he directed part of the 600 million dollars from the Pdvsa-Rantor operation to the accounts of Maduro’s three stepchildren, Walter, Yoswal, and Yosser Gavidia Flores, identified in the recordings as “los chamos,” represented in some meetings by Mario Bonilla, according to court records and multiple sources familiar with the federal investigation in Miami and Spain, indicating that Maduro’s stepchildren and the autocrat himself are also under investigation in this case.

Pdvsa-Rantor Loan Case: Dismissed Cause

In light of the revelations of the Money Flight Operation and the unfolding events, Raúl Gorrín tried to shield himself from a probable accusation and decided to leverage his knowledge and influence over the Venezuelan judicial system, as well as his contacts with prosecutors and judges, notably Maikel Moreno, who was then president of the Supreme Court.

Thus, on September 16, 2020, the 11th Criminal Court in Caracas dismissed the case against Raúl Gorrín, Gustavo Perdomo, and Víctor Aular stemming from the “timely” complaint filed by Oscar Ronderis Rangel, a deputy representing Nueva Esparta, regarding the irregularities committed in the loan agreement between PDVSA and Rantor in 2014. The legislator, based on the report published by Cuentas Claras Digital, requested an inquiry into the potential damage caused to the oil company’s assets as a result of the contract in question.

Oscar Ronderos Rangel, deputy for Nueva Esparta, member of Bernabé Gutiérrez’s group. Photo: La Hora Online

Oscar Ronderos Rangel, deputy for Nueva Esparta, member of Bernabé Gutiérrez’s group. Photo: La Hora Online

In an unusual move, it was the prosecutor of the case, Farik Karin Mora Salcedo, widely known for his controversial and irregular actions favoring the regime’s interests, who requested the judge Luisa Romero to dismiss the case in favor of Raúl Gorrín, Gustavo Perdomo, and Víctor Aular, who is now surprisingly detained for an identical cause related to the contract between Pdvsa and Atlantic. The same Public Ministry that requested the dismissal approved by the court is now the one accusing and detaining Víctor Aular.

The court ordered “the cessation of any personal or real measure concerning the aforementioned individuals (Gorrín, Perdomo, and Aular) regarding the facts covered by this decision.” The court’s ruling, based on a supposed accounting expertise conducted by the Financial Expertise Division of the CICPC and the opinion of Pdvsa’s own legal consultancy, asserted that the operation “did not demonstrate harm to PDVSA’s assets.” Moreover, the ruling exonerated Carmelo Urdaneta, legal advisor to the Ministry of Petroleum, who is now a convicted felon in the US, where he has acknowledged receiving bribes related to the Pdvsa-Rantor contract.

Judge Luisa Romero ruled that Gorrín and Perdomo did not participate in the negotiation and do not hold shares in Rantor Capital CA. Indeed, as found in the investigation by Cuentas Claras Digital in 2017, Gorrín does not appear in the records of Rantor Capital CA, but all indications point to him as the ultimate beneficiary. This is confirmed in the second phase of the operation when Rantor Capital ceded the contract with Pdvsa to Eaton Global Services Limited, a company registered in Hong Kong that ultimately received all the Pdvsa dollars and in which Raúl Gorrín holds 100% of the shares.

The judicial decision, the actors involved, and the timing of these events indicate that the dismissal is merely another judicial farce to grant impunity to the accused, particularly Raúl Gorrín and Gustavo Perdomo, who are fugitives from US justice where they are facing charges in three different cases, as well as in Spain and Switzerland, where investigations are ongoing.

The dismissal prevents the accused from being tried in Venezuela for the same case, granting them impunity in the country but could also be relevant in judicial proceedings opened in other jurisdictions.

The Best Business in the World

During the years when currency control was enforced in Venezuela, there was no better business than buying cheap dollars at the so-called preferential rate and selling them at a high price on the black market. This is known as profit from currency differentials.

On December 17, 2014, the date of the contract between Pdvsa and Rantor Capital CA, the official rate was 6.30 bolívares per dollar, meaning the 7.2 billion bolívares equated to 1.143 billion dollars. However, in the parallel market, the rate was 182.23 bolívares per dollar, so Rantor only had to exchange less than 40 million dollars on the black market to obtain the 7.2 billion bolívares it had to lend to PDVSA. The remaining difference, about 560 million dollars, was the profit from the currency differential shared among Raúl Gorrín, Nicolás Maduro’s family members, top officials from the oil company and the Ministry of Petroleum, advisors, bankers, and financial operators, among others. Undoubtedly, an obscene profit.

Profits from currency differentials related to different schemes like structured notes, payment of external debt, bond issuance, CADIVI quotas, CENCOEX, SIMADI, swaps, and payments to suppliers, among others, emerged at the same moment Hugo Chávez established currency controls. This created a kleptocratic caste (criminal state) resulting from the marriage of public officials with private individuals, aiming to access gigantic businesses through currency differentials (the great plundering), the most savage extraction of public money any country has ever experienced.

Pdvsa, which had been one of the most important companies in the world, was not immune to the unbridled greed of both insiders and outsiders for cheap dollars. Alejandro Betancourt, owner of the controversial company Derwick Associates, identified with corruption in the electricity sector, responsible for the blackouts experienced by Venezuelans, not only sold dubious quality electrical equipment at inflated prices to the Venezuelan state but also made his most profitable operations in Pdvsa, supported by Rafael Ramírez, precisely through loan agreements in bolívares payable in dollars.

To achieve this, Betancourt and the network of corruption within the oil company utilized shell companies without experience in the field, such as Atlantic, owned by Juan Wallis Brandt, and Violet and Welka owned by Luis Ignacio Oberto during Chávez’s government, and later Rantor and Eaton owned by Raúl Gorrín during Madura’s administration.

The Legality of the Contracts

Following El Aissami’s and Saab’s accusations, Rafael Ramírez defended the legality of the loan agreement in bolívares payable in dollars signed with Atlantic. According to Ramírez, the purpose of the contract between PDVSA and Atlantic, for example, was to obtain bolívares to pay national suppliers at a more favorable rate than that offered by the Central Bank of Venezuela, which is why the oil company engaged in loan operations with private institutions. An interpretation of the Exchange Agreement No. 9 between Pdvsa and the BCV indicates that the oil company can use part of its foreign currency income to cover its operational expenses.

Another reason for creating this mechanism during an election year with a sick candidate, Hugo Chávez, was financing the ruling party’s campaign. According to statements from Rafael Rieter, former head of Pdvsa security now under investigation in Spain, part of the resources from this operation was used for the abusive financing of the PSUV campaign during the presidential election of October 2012.

There are ample reasons for suspicion regarding the legality of these confidential Pdvsa operations, both those carried out during the Chávez-Ramírez administration and the subsequent ones under Raúl Gorrín during Maduro’s administration.

Let’s analyze:

- The lack of transparency in how private companies were selected, companies without recognition or track record in the subject. Why didn’t PDVSA conduct public auctions?

- The role of the BCV, if any, in monitoring these transactions is unknown.

- If these operations were legal, as Rafael Ramírez and Raúl Gorrín claim, why was bribery of officials needed, some of whom have pleaded guilty and are being prosecuted in other jurisdictions, like Carmelo Urdaneta?

- Why, with a wide network of public and private banks at the time, was there a preference for secretly resorting to two private financial institutions allowing them to pre-sell Pdvsa’s dollars to obtain the bolívares needed for lending?

The Contradictions

In 2020, the Public Ministry requested the dismissal of the case against Víctor Aular and his protection in the matter regarding the contract signed between Pdvsa and Raúl Gorrín through Rantor and Eaton companies. Today, in an identical case, the same Public Ministry accuses and detains Aular, who appears representing Pdvsa in both contracts.

A KPMG report was used by the Public Ministry to exonerate Gorrín, Perdomo, and Aular in 2020, as detailed in the dismissal document published as a scoop in this article. Today, the international consultancy is disqualified by Tarek William Saab.

An internal Pdvsa report recommended in 2019 to refer the contract with Atlantic to the Attorney General’s Office. This information was published on December 12, 2019, on the official page of the Ministry of Communication and Information. However, just this week the Oil Minister went to the Prosecutor’s Office to file the report with Tarek William Saab, who declared that the investigation was just beginning.

Finally, if the opaque contract between Pdvsa and Atlantic is illegal, as the regime now claims, what about the contract with Rantor from Raúl Gorrín, which has identical features and involves Maduro’s own stepchildren?

As we’ve mentioned, the Venezuelan judicial system, controlled by the autocrat, only acts when it suits Nicolás Maduro’s political interests, although in this case it seems to have shot itself in the foot.